Latest News

Latest News

Foxxum, ZEASN, and rlaxx TV Shine at IBC 2023 in Amsterdam

EVENTS / June 7, 2023

The IBC 2023 in Amsterdam proved to be a resounding success as Foxxum, ZEASN, and rlaxx TV delivered an unforgettable showcase of their latest innovations in CTV technology.

At the heart of their presentation was the highly-anticipated demonstration of Whale OS and its impressive array of features. Attendees were highly impressed by the seamless integration of content, applications, and AI-driven enhancements. The AI features of Whale OS were especially popular, leaving people astounded by its capabilities.

The trio’s booth was a testament to innovative design, drawing visitors in with its futuristic aesthetics, immersive displays and for everyone’s delight: a serving of fresh popcorn. This modern but homelike design served as a fitting backdrop for showcasing the companies’ collective vision for the future of connected TV.

This remarkable success was achieved through incredible teamwork within a very short time, as the acquisition of Foxxum and rlaxx TV by ZEASN only took place in August 2023. The new group seamlessly collaborated to create an unforgettable experience for IBC 2023 attendees.

Moreover, the IBC 2023 audience was treated to captivating speeches by industry luminaries Dr. Jack Gao and Professor Feida Zhu. Their insights and vision for the future left a lasting impression on all who attended.

As the curtains close on IBC 2023, Foxxum, ZEASN, and rlaxx TV are excited to announce their commitment to returning next year, promising even more groundbreaking innovations and industry-leading presentations. The future of smart TV looks brighter than ever – See you at IBC 2024!

Foxxum will be at IBC 2023 in Amsterdam!

EVENTS / August 14, 2023

We are happy to announce that Foxxum will be present at the International Broadcasting Convention (IBC) in Amsterdam this September 15-18! IBC is the premier event for professionals involved in the creation, management and delivery of entertainment and news content worldwide.

This year, we are taking our presence at IBC to a whole new level by teaming up with our new acquisition partner, ZEASN. Together, we aim to revolutionize the CTV entertainment landscape and redefine the way people experience content on smart TVs and connected devices.

Join us at booth #5.A08 to explore our cutting-edge solutions and experience first-hand the power of our partnership with ZEASN. Our team will be on hand to demonstrate our latest innovations, showcase our diverse range of applications, and discuss how our combined strengths will reshape the future of the smart TV experience.

Don’t miss this opportunity to connect with Foxxum and ZEASN and stay ahead of the rapidly evolving trends in the industry. We look forward to meeting you at IBC 2023 and forging new collaborations that will drive the future of CTV entertainment!

Book your meeting with our colleagues via email info@foxxum.com

Use our Customer Code IBC10100 and get your tickets now!

ZEASN Acquires Foxxum and rlaxx TV to Establish the Leading Independent CTV OS and AVOD/FAST Product

PRESS RELEASE / August 1, 2023

Singapore, August 1st, 2023: ZEASN Technology Private Ltd, a leading provider of solutions and services for smart homes, announces the acquisition of Foxxum GmbH, a leading provider of innovative CTV solutions, and rlaxx TV GmbH, an international AVOD/FAST streaming service. With this strategic move, the strengths of all three companies are combined, positioning ZEASN as the leading independent provider of CTV operating systems (OS) and AVOD/FAST products in the market.

With an installed base of 85 million CTVs worldwide and an AVOD/FAST service accessible on 1.2 billion devices in 27 countries, the combined companies offer a powerful and extensive platform for content distribution and monetization of user engagement.

As part of the integration process, Whale OS 3 and Foxxum OS 4 operating systems will be merged into the new Whale OS 4. The creation of Whale OS 4 will lead to accelerated growth and aims to grow from the combined installed base to over 200 million within 3 to 5 years. Additionally, the acquisition of Foxxum significantly expands the app portfolio of Whale OS 4. Combined with ZEASN’s AI-enabled algorithms, data tracking tools, and personalized recommendations, Whale OS 4 intelligently curates content tailored to individual preferences. This empowers viewers to explore and enjoy new and exciting streaming options while enabling advertisers to effectively reach their desired audience.

The global streaming service, rlaxx TV, will be integrated with ZEASN’s streaming service, Whale Live, to create an even more captivating platform. The merged services will continue to operate under the name rlaxx TV, offering a wide variety of appealing content to viewers worldwide.

A key aspect adopted from Foxxum’s successful business model is the unique sharing of 80% of the monetization revenue of CTV operating systems with partners. This revenue-sharing approach will be incorporated by ZEASN and retained under the current name Mission 1 Joint Venture Alliance.

All Foxxum and rlaxx TV executives will remain on board, assuming leadership positions within the newly formed group. Their expertise and industry knowledge are invaluable in driving the company’s future growth and success. The current shareholders of both Foxxum and rlaxx TV assumed shareholder positions in the group, underscoring their confidence in the combined entities’ strategic direction and immense potential.

“We are delighted to welcome the talented teams from Foxxum and rlaxx TV to the global ZEASN family operating now in Europe, China, India, and North America to serve our customers globally,” says Jason He, CEO of ZEASN. “Their expertise and market position, combined with our existing capabilities, will propel us to new heights in the CTV industry. Together, we will redefine the CTV landscape, offer a compelling alternative, and deliver world-class experiences for viewers. This is a significant step in preparing our company for a future IPO.”

“The combination of three strong companies will accelerate our strategy to form the leading independent player that our customers have long demanded,” says Ronny Lutzi, CEO of Foxxum and rlaxx TV. “From day one, we are poised to swiftly outpace other independent players, surpassing them not merely in sheer installation numbers, but also through our industry expertise.With solid support from the global TV supply chain, we aim to position ourselves at eye level with industry giants like Google TV and Roku. I am extremely excited to merge our efforts with ZEASN. It feels like two parties have found the perfect match.”

The first public presentation will take place at IBC 2023 in Amsterdam from September 15th to 18th, 2023, where ZEASN, Foxxum, and rlaxx TV will showcase their joint vision, products, and solutions.

Click here to download as PDF

OneFootball is Partnering with Foxxum to Co-Develop CTV App

PRESS RELEASE / November 3, 2022

We are thrilled to announce our partnership with OneFootball to co-develop their Smart TV App OneFootball TV on select devices and pursue other strategic initiatives to bring OneFootball TV even closer to the fans.

Read the full news here: Onefootball.com

Medientage München Blog Interview with Foxxum President Dirk Wittenborg

PRESS / August 23, 2022

Our president Dirk Wittenborg gave an interview with the Medientage München Blog on how CTVs and CTV OS are already rapidly changing the world of content consumption, the impact of major gatekeepers on the market, and how Foxxum CTV OS and its AVOD streaming app rlaxx TV will help shape the future of the CTV and CTV OS landscape as truly independent providers. Below you can find the English translation of the interview.

To read the original interview in German visit the Medientage München Blog.

Dirk Wittenborg:

The Robin Hood of TV

The President of Foxxum wants to defy Amazon, Google, and the other major global tech companies. Strategist Dirk Wittenborg describes how the online giants are already pressuring TV software suppliers. And why, in his opinion, the operating systems will decide how the Connected TV market will be divided up.

In an interview with the Medientage München blog, Dirk Wittenborg outlines what opportunities regional providers have, how money can still be made with TV, and where he sees his role with Foxxum in this.

Mr. Wittenborg, how do you make money as a CTV OS provider like Foxxum?

Until Amazon and Google entered the market, providers were able to make money from both licensing revenues and the marketing of usage time.

Today, the only way to make money is to market the time of usage. The money pot is huge, but it is dependent on advertisers discovering CTV for themselves. This is increasingly happening. But the success has to prevail against seemingly invincible giants who are not afraid to use their concentrated power in this competition.

You don’t shy away from provocative statements. For example, at the Medientage Special “Connect!” you stated that there had been practically no user innovations in the TV market for decades: So why are the providers of operating systems for Connected TV (CTV) vying for this market anyway?

Assuming that in the future all media consumption in the living room will be via streaming (realistically more than 80 percent), we are talking about a market that is huge. In the future, the CTV OS will control the last mile from the device to the sofa.

Whoever is in control decides what is offered. Whoever decides what is offered, controls the money.

“TV is the last big market that will be massively changed by the Internet.” – Dirk Wittenborg, Foxxum

There are around 1.6 billion TVs in use worldwide. Of these, around 1.2 billion are CTVs. With about 3.5 hours of use per day, we are talking about 1,533 billion hours per year. Since more and more TV sets are connected to the Internet, this total usage time is up for redistribution.

With 8 to 12 minutes of advertisement per hour (standard in linear TV), an advertising duration of 20 seconds each, and revenues of $15 per thousand contacts (CPM), we are therefore talking about a market that has a potential advertising value of USD 548 to 821 billion annually. Not all revenues will be generated through advertising. But the market size remains the same, whether it’s through advertising or subscription fees.

The chance to redistribute is now luring the big American players. Who knew Netflix, Disney+, Amazon Prime, Pluto TV, Tubi TV, Samsung TV +, Roku Channel 10 years ago? All of them are today’s heavyweights. And the term CTV OS is not older than five years. Besides, the whole competition has evolved from a solely local and regional competition to a global Formula 1 race. And as in Formula 1, the key success factor is money.

Compared to this, almost all European TV stations are simply too small to keep up. And most of them have long since missed the moving train and have to settle for managing historic successes with declining significance.

The CTV OS will play the all-important role in this race and will be the key to making money.

How?

How the CTV OS can make money? Well, 10 percent comes from licensing revenue or placement fees on the home page or remote. 90 percent is based on usage time. Services like Netflix or Disney+ or Prime Video account for a large share of usage time, with more than 70 percent combined.

These services do not share revenues with the platforms, because without them no manufacturer would be able to sell any TV sets. But this will also change once the consolidation of the CTV-OS platforms begins. Currently, 80 percent of viewing time revenues come from the platform’s own ad-supported services (AVoD/FAST). Take Roku, for example: today it’s already 41 U.S. dollars per device per year.

For now, the goal is to get the largest share of TV sets united on one CTV OS. Once that is achieved, the screws will be tightened. In addition, new players will enter the TV market very soon. I’m sure we’ll soon see Microsoft, Facebook/Meta and also Nvidia here.

Microsoft has actually now been hired by Netflix as a technology partner for advertising; the streaming service is bringing an ad-supported, lower-priced offering. Are we already off and running yet?

At the moment, CTV is gaining massive shares of the overall advertising market and it was the logical consequence for Netflix to add advertising to the model. Even if the step comes much too late. Setting up everything yourself takes too long.

All alternatives to Microsoft are competitors of Netflix, directly or indirectly. So Microsoft was the only viable alternative. And Microsoft probably offered the best deal. Just a later switch from AWS to Azure would allow Microsoft to deliver everything to Netflix for free. In the end, it’s not even Microsoft that’s delivering the ad tech, but Xandr. An ad tech company that was recently purchased by Microsoft.

I assume this is just one of many steps Microsoft is taking to become a leader in TV. With the completion of the Activision purchase, Microsoft will eventually try to acquire Netflix. Perhaps even alongside acquiring Roku, which was originally created from Netflix.

This would take Microsoft from absolute abstention from TV, to the position of market leader within a rearranging TV market in no time. With all components from one source: CTV OS Roku, streaming service Netflix, ad tech Xandr and very deep pockets to outrun everyone else.

At the Connect! conference, you outlined a scenario according to which Amazon (Fire) and Google (Android) will – once again – dominate the CTV OS market, which will only be global in the future. What will the consequences be if these two are the new gatekeepers in the TV market?

CTVs have removed the regional boundaries of TV as we’ve known it for over 90 years. Disney is a good example. Five years ago, Disney was dependent on regional partners to reach customers. With Disney+, Disney has quickly created direct global access to customers and pulled content from partners.

Amazon just recently bought MGM. As a result, MGM content now goes directly to customers via Prime Video. Worldwide. Tech giants like Amazon, Google, Microsoft, Facebook, and Apple will aggressively use their financial power.

I just read, “ProSieben is running out of Hollywood movies.” That’s no surprise. CTV allows all content providers to reach end consumers directly. Without sales intermediaries like ProSieben or RTL. Anyone with strong content will go the direct route, and we’ll see more consolidation through buys on the content side, too. What’s left for TV stations is just B-grade or expensive in-house productions. But that’s getting harder and harder with declining advertising revenues.

“It used to be: Hollywood produces, the rest of the world distributes and markets. The new reality is: big tech produces, distributes, markets and monopolizes. And all of that is 90 percent controlled from the United States.” – Dirk Wittenborg, Foxxum

What does this mean for Foxxum, what is your strategic goal?

With Foxxum, we have a CTV OS in the race. But in competition with Amazon and Google or even Samsung and LG, we have a solid challenge to overcome. However, many market players – especially the many regional brands that exist in every country – want an independent provider. Therein lies our opportunity.

With rlaxx TV, we have established a very successful ad-financed service that is already present in 26 countries and is attracting a great deal of interest from content providers, especially in the USA, as a truly independent provider.

Robin Hood took from the exploiting rich and gave to those in need. I have a certain sympathy for the idea of being the Robin Hood of TV.

Content aggregators and channel platform wanted to put themselves into position as gatekeepers; and you do both, platform and OS, with rlaxx TV and Foxxum. Will the boundaries between OTT aggregators and OS providers dissolve?

All OS providers establish their own AVOD services. Roku with Roku Channel, Samsung with Samsung TV+, LG with LG Channels, Amazon with Freevee, Google with Youtube. In the end, it’s a double gatekeeper strategy. First the OS to control access to the living room, and then using the power of the gatekeeper to direct viewers to its own service.

For some, like Amazon and Google, this is then combined with massive financial incentives to establish their own CTV OS. And big brands succumb to this incentive, like mice that only smell the cheese but don’t notice the trap.

What is left of a brand like Philips or Sony when it has been marketed and presented for years in combination with the Google brand? And what happens when Google then suddenly produces its own TV sets? What will the customer buy then? Sony or Google? The cheaper device. And that will then be Google.

Amazon has led the way. After first introducing its own CTV OS to many TV brands with many incentives, it has now launched a TV under the Amazon TV brand. Combined with the power of the sales channel, Amazon can arbitrarily influence market shares of competitors, and any brand using the Amazon CTV OS must follow the price dictate of Amazon TV. The customer no longer makes a distinction between the TV brand and the OS brand. As long as the same thing is included, the cheaper product will be bought.

What role does (quality) content still play considering these possible developments? After all, it’s expensive and currently THE argument used by services from Amazon to Netflix to Disney+ to achieve reach and money through increasing subscription numbers.

Netflix’s rising subscription numbers are already a thing of the past. While Netflix was the undisputed market leader just three years ago, Disney+ is about to overtake Netflix. And meanwhile there is more and more competition: Prime Video, Apple TV+, Disney +, Paramount, Discovery, Peacock, Crackle, Starz and then also regional giants like Jio in India.

Talking about quality is only appropriate anyway if you equate quality with quantity. In the constant race for more subscribers, everyone tries to outrun the others. Unfortunately, mostly only by quantity and less by quality. In the end, a good comedy or a good action movie can always be replaced by another one. Therefore, so-called quality content is often interchangeable.

Disney is certainly an exception, as the brand itself and the content brands like Marvel etc. are particularly strong. The only remaining differentiation is in the so-called event-based content like sports or music. In other words, things that are only good as originals and that cannot be copied. This is where the money will flow in the future and the prices for such content will continue to explode.

„Only those can participate in the game, who can afford to do so financially.“ – Dirk Wittenborg, Foxxum

And those are the same ones again. The latest license purchases by Amazon and Apple are proof of that.

Furthermore, I believe that content from local cultures will play a stronger role with global distribution. Because today it’s much easier, for example, to bring a Spanish production to the screen globally within a short period of time.

You postulate that the platform (OS) will become more important than the streaming service. How can the services still counteract this now?

Some services make it very easy for the big ones like Amazon and Google to expand their position of power. Netflix and Disney are good examples. Every new OS version from Amazon or Google is supported and smaller ones like Foxxum always have to wait. With the effect that TV brands then switch to Amazon or Google due to a timelier availability. But if Amazon or Google succeed in achieving a dominant market share, the streaming services will live to regret it. Because that’s when the power play will really begin.

But the big global streaming services have other things to worry about right now and are currently only thinking about how to gain more subscribers, and increasingly, how to avoid the decline. And everyone will be looking more and more at how to cut costs to avoid declining share prices.

On a regional level, it is frightening to see how naive many market participants are. Every now and then, there’s a discussion about what the German broadcasters could do. And then someone immediately cries “cartel” – which is ridiculous.

“Even if all German broadcasters united to create a streaming service, this service would be a barely recognizable dwarf in context of the current global competition.” – Dirk Wittenborg, Foxxum

The solution: all European TV channels on rlaxx TV. That would then be relevant and would establish the balance of power. But in Europe, we love debate and avoid decisions until once again it’s all in American control.

Beyond that, many things fail because TV broadcasters believe that all you have to do is make a streaming service and success will come because you are successful as a TV broadcaster. Relative market shares in streaming such as those of Joyn or RTL+ of less than 2 percent paint a clear picture.

The regional services simply have to understand that competition no longer takes place on a regional level and that success is only possible if you quickly join forces with old competitors. However, this will probably fail because everyone considers themselves to be the most important part and wants to dominate such a joint effort, and then it all fails in the end.

Or in other words, historical success produces big egos that stand in the way of joint action until the inevitable happens and it’s too late.

Dirk Wittenborg was one of the experts at the Medientage special Connect – The Future of TV. The event can be listened to in episode 78 of the Medientage Podcast.

About Dirk Wittenborg:

Dirk Wittenborg is Co-Founder and President of Foxxum, a CTV Operating System (OS) provider used by major TV Brands worldwide. Inspired by Apple’s introduction of the iPhone shortly before, Foxxum started with the idea to develop a smart set-top box back in 2008. With the rise of smart TVs, Foxxum became increasingly requested to share experience and technical solutions with TV manufacturers helping to capture the upcoming market opportunity. Since its foundation in 2011, Foxxum has grown into a worldwide leader, partnering with major TV brands.

In 2020 Dirk and Ronny Lutzi, Co-Founder of Foxxum, launched the FAST/AVOD service rlaxx TV. Within its first 12 months the service was rolled out on 100% of all connected devices, launched in more than 25 countries, and will become a significant revenue contribution to the Foxxum CTV OS in the near future.

Before Foxxum, Dirk worked in banking and strategy consulting with one of the major consulting firms. In 1997 he moved on to his first entrepreneurial role by founding a strategy consulting boutique that developed a fast-growing international business within three years, before it was acquired by a software and technology consulting group in 2000. In 2002 Dirk established the investment holding Axxola with majority investments in fashion, education service, coffee and coffee machines, dune buggies, and hospitality in Brazil, Germany, and Spain. He also holds his Foxxum investment through Axxola.

Dirk holds a master´s degree in business administration, is passionate about water sports activities, and is a father of five girls.

Foxxum and Radioline partnering to create In-Vehicle Infotainment System (IVI)

PRESS RELEASE / March 11, 2022

Kiel (Germany), March 11th, 2022 | The global smart TV solution provider and innovator, Foxxum, will be working on an In-Vehicle-Infotainment (IVI) solution with Radioline, a global radio and audio provider, after having successfully made Radioline’s smart TV app available on all Foxxum OS-enabled devices in the past.

Radioline’s automotive app offers the largest catalog of 110,000+ local and worldwide radio stations, web-radios, and podcasts (over 10 million episodes), with curated and Premium content catalogs ranging from news, sports, talks to music with channels such as World’s Best and HQ Radio. The app is available in 18 languages, in an intuitive UI designed for in-car experience.

The IVI app features a unique one-touch export of tracks to streaming playlists (Deezer, Spotify, Apple music), search engines, downloadable podcasts, a player, as well as mini- player modes without advertisements, plus, multi-device features where content is synced and can be streamed from several devices – from CTV and mobile to IVI.

“Foxxum has an impressive footprint in Connected TV in a fruitful relationship with us, we are confident in their success in the automotive sector” underlines Xavier Filliol, COO at Radioline.

“We are very pleased to collaborate again with Radioline and build upon our established partnership in CTV, with an IVI radio app which will further expand our presence in the automotive business”, says Ronny Lutzi, CEO at Foxxum GmbH.

Click here to download as PDF

Foxxum Among Finalists at Digiday Video & TV Awards 2022

ANNOUNCEMENT / February 10, 2022

We have some fantastic news to share: Foxxum has been nominated as a finalist at this year’s Digiday Video & TV Awards in the category ‘Best Connected TV Platform’ among the other CTV platform nominees Atmosphere, Digital Remedy, Innovid, Premion and Publica.

Digiday Media is an American media company that delivers news on media, advertising, and publishing topics on a daily basis through its online media magazine, Digiday. Furthermore, Digiday organizes events such as industry summits and awards like the Digiday Video and TV Awards, which recognize technologies, companies and campaigns in the video and TV industries that are modernizing and innovating the scene.

We are beyond proud to be recognized for our expertise and experience which we have gained over the past 10+ years since Foxxum’s founding. During this time, we have become a global leader in the development, operation, and commercial marketing for innovative and customized CTV solutions as well as CTV/smart TV app development solutions and have been working with a wide range of TV brands and OEM manufacturers worldwide such as Hisense, Vestel, Toshiba, TCL, and Sharp.

All of this wouldn’t have been possible without our loyal and amazing team – so many thanks to everyone here at Foxxum for their hard work and dedication.

In addition, our sister company rlaxx TV has been nominated twice in the categories ‘Best FAST Service’ and ‘Best Streaming Service’. This puts rlaxx TV in line with other nominees such as Samsung (FAST Service) and CBS Interactive and Discovery, Inc. (Best Streaming Service).

We look forward to the announcement of the winners on March 24, 2022. For more information about the awards and the full shortlist, you can click here.

Foxxum and Cinemo to Power Connected In-Vehicle Infotainment Systems (IVI) with Connected TV

PRESS RELEASE / December 23, 2021

Kiel (Germany), December 23, 2021 | Global smart TV solution provider and innovator, Foxxum, is collaborating with Cinemo, a global leader in automotive infotainment embedded solutions, to power a new In-Vehicle Infotainment (IVI) experience using Foxxum’s software and customizable CTV solutions.

With 10 years of experience in developing and optimizing solutions for CTVs and its apps, Foxxum is now expanding its scope and dedicating itself to the increasingly digital automotive industry, which continues to emerge as the next level in the streaming business.

Cinemo, a leading provider of automotive infotainment middleware, develops powerful and high-quality multimedia and streaming solutions, that enable the world’s leading automotive brands to build innovative and delightful IVI solutions for drivers and passengers alike.

In-Vehicle Infotainment (IVI) offers car drivers and passengers an ideal combination of entertainment and information, along with a safer way of interaction by using large touch screen displays, button panels and voice commands. IVI solutions include a wide range of content, kid-friendly and safe entertainment and serve as a perfect distraction while charging the car.

Foxxum will provide automotive clients with access to a variety of its extensive global entertainment content, along with a hub that can be customized to the user’s preferences and provide access to the most frequently used content, such as VODs and live TV channels.

Through this collaboration, Foxxum can leverage its strong relationships with its content partners to give them an opening in IVI in addition to the reach in CTV, without having to work with another partner.

A first demo of this joint IVI solution will be presented at the tech conference CES, which will take place in Las Vegas on January 5-8, 2022. Individual appointments can be arranged via foxxum.com/contact.

“’Made in Germany’ is a true seal of quality in the automotive industry, and that’s exactly what we can ensure with our new IVI solution Foxxum Car OS. With Cinemo, we have found the perfect technology partner with whom we can bring German quality and innovation to the global market,” says Ronny Lutzi, Foxxum CEO and Founder.

Click here to download as PDF

ADZINE Interview with Foxxum’s President Dirk Wittenborg

PRESS / October 18, 2021

Foxxum’s president Dirk Wittenborg sat down for a highly interesting interview with the German news magazine ADZINE to talk about the current state of the CTV world and market – from monetization options for operating systems to toll bridges, walled gardens, and the general outlook of the CTV world in the future, among other topics.

Below you will find the translated English version of the interview. To read the original German interview on the ADZINE website, click here.

The Global Battle for Toll Bridges in CTV

When people in the advertising industry talk about CTV, most people immediately think of app providers and their streams. However, there is another level before that – the operating systems. With Foxxum, Dirk Wittenborg introduces such a CTV operating system, which is used by various TV brands in a similar way to Android TV or Amazon Fire. After Samsung, Foxxum is the second largest CTV platform in Europe, but nobody knows this because it’s used as a white-label solution. Simultaneously, Foxxum’s Kiel-based team develops CTV apps and operates rlaxx TV, a linear AVOD+FAST service. In this interview, Wittenborg explains why the real battle in CTV is taking place worldwide at a platform level and who will win the race.

ADZINE: Hello Dirk. How does the marketing on CTVs work when we go to the level of operating systems?

Dirk Wittenborg: Generally, the app providers work together with the platform partner, for example with us or Samsung. Nowadays, this often boils down to an inventory split because Amazon has shaped it that way. The platforms often want thirty percent of the inventory – which is just insanely expensive because it’s usually not there as a margin. We do this differently. For example, the TV manufacturer Sharp uses our operating system in Europe. We take over the marketing here and share the revenue with the brand.

ADZINE: What are the monetization options for operating systems?

Wittenborg: There are three levels: firstly, there’s the placement – if someone wants to, for example, sit next to Netflix on the landing page. These are the so-called placement fees. That’s when display banners are possible on the landing page of the platform.

And thirdly, you can work with pre-rolls or post-rolls, depending on the legal agreements in the video playout. Of course, you need the appropriate permissions for this. At rlaxx TV, we show an advertising video in a recommendation layer, where we recommend content from another app before it gets clicked. However, the partner must first allow the recommendation, followed by the marketing.

ADZINE: What about pre-, post-, and mid-rolls within streams?

Wittenborg: At this point, we’re directly in the video playout. Starting from an ecosystem, you take the app to a foreign country. Usually, the app owner takes over the marketing there, but signs a revenue share agreement with the platform. The classic rate for distribution is thirty percent, which dates all the way back to the old YouTube world. As I said, today it’s often not thirty percent of the revenue, but rather thirty percent of the inventory.

ADZINE: Advertisers are very interested in advertising on CTV, but it hasn’t really taken off yet, at least in Germany. What’s the problem?

Wittenborg: Germans are, simply speaking, specialists in making everything complicated. Marketing in CTV in this country often runs through sisters of the traditional TV marketers. Prosieben and RTL try to keep this situation as stable as possible for as long as possible. And the advertising industry is very conservative, they are doing what they know for now.

Nevertheless, U.S. players like Roku and Pluto are already here. Their advertising models are already established in the U.S., and they will also establish themselves here through view time and aggressive marketing.

ADZINE: The CTV market in Europe is very fragmented. Recently, one of our guest authors – from RTL – outlined an AdTech platform for CTV that covers several European markets and bundles TV-like advertising inventory. Do you think this is realistic?

Wittenborg: It’s realistic, but it won’t happen. It’s like the old Roman Empire. It’s a question of who sets up the toll stations. On the one hand, we have the cable network operator, who determines – via his subscribers and his set-top box – which of the advertisers gets into the living room. Then we have the satellite distribution channels like SES Astra, which in turn determine what it costs there.

In CTV, you’ll find walled gardens like from Samsung or LG. Sony and Phillips run ninety percent of their TVs on Android TV, so this walled garden is effectively run by Google. If someone wants to start an advertising community for CTV, then it’s called Google in the end anyway. But they’re definitely not going to join anywhere.

ADZINE: Who is building the most toll bridges?

Wittenborg: There’s a lot of speed on the market. In the U.S., Amazon has just announced that it’s developing its own TV set. They already sell their own chips for their cloud service, and the next step will be chips for end devices, like Apple is already doing. The goal here is maximum distribution of the toll bridges.

At a local level, the players are all different. The television market in Austria is perhaps still similar to the one in Germany, but in France or Spain it’s completely different. In the CTV field, Android, Amazon, Roku and maybe Facebook are the main players with global ambitions. There just aren’t many that market globally.

ADZINE: What made you think of Facebook?

Wittenborg: Facebook is looking for growth. Users on social media are no longer growing as strongly and advertising intensity has been exhausted there too. So, outside of the mobile space, the big TV screen is still the best place to advertise.

It’s just a question of who Facebook buys. Maybe it will be Roku – they only cost forty-five billion. Microsoft is sure to follow the same strategy soon. They could even buy Roku and Netflix with ease. And Disney, too, if they wanted to. In two years, Disney will have surpassed Netflix, and then it will be exciting to see what the even bigger ones do.

To put it this way: The giants in the USA have woken up. Amazon has just bought some content from MGM for 9 billion. But that’s still low compared to what one can spend.

ADZINE: Who do you see as the winner of this game?

Wittenborg: Netflix doesn’t have the financial strength to compete against players like Amazon, Google, or Facebook once they build the toll bridges and simply copy and displace Netflix. Disney, too, is very strong worldwide and has content brands like Mickey Mouse or Marvel and even theme parks – Netflix is far away from that. Plus, a lot of the content today is produced just to keep subscribers from leaving. So, the cost of content is going up, as is the cost of marketing due to increased competition.

ADZINE: How is this resolved?

Wittenborg: Above all, there will be a big race for the toll bridges, i.e., there will be a battle for the operating systems. Sixty percent belong to the big brands like Samsung, LG etc. forty percent are independent. Here in Germany these include Medion or Orion from the Otto Group. In each country, there are between three and five local brands, which are usually as big as Samsung. Everyone is fighting for this market right now. Samsung has gone from being a manufacturer to a global broadcaster. No one is attacking them directly, so it’s better to offer the local brands an operating system. That’s what we’re doing. For two years now, we’ve been competing with Android, Amazon, and Roku.

Google pays manufacturers ten dollars to use their operating system. At one-hundred million TV sets, Google is pricing the ticket to enter the game at a billion – in the first year. To build a base, they need five to seven years. That puts us at five to seven billion U.S. dollars, and that’s how much it costs just to participate. That’s an expensive gig.

ADZINE: Thank you very much for the interview!

Foxxum Develops Smart TV App for Turkish Avod Service Puhutv

PRESS RELEASE / October 19, 2021

Kiel (Germany), October 19, 2021 – Foxxum, global and innovative leader in the Smart TV solutions sector, has partnered with Turkey’s first and biggest premium AVOD streaming service puhutv to develop their smart TV app.

puhutv is part of the Doğuş Group (Doğuş Holding A.Ş.), which is one of the largest, privately held conglomerates in Turkey. Their portfolio includes more than 300 companies with six core businesses in the automotive, construction, hospitality & retail, real estate, energy, and media sector, to which puhutv belongs.

Foxxum has been collaborating with Doğuş for years, having developed other smart TV apps such as Kral TV, and they are now continuing their successful partnership by utilizing Foxxum’s outstanding smart TV know-how for the app development of the premium AVOD streaming service puhutv.

The puhutv app offers viewers TV and film content, comprised of foreign and Turkish films that range from dramas to comedies, Turkish soap operas, documentaries, music and TV shows, live broadcasts as well as their originally produced content, puhutv Original.

The app will be available in Turkey in Turkish, Arabic, and Spanish and can be accessed on the Foxxum-enabled smart TV devices Hisense, Blaupunkt, Profilo, Vestel and Sharp and on the smart TV brands Samsung, LG, Beko, Grundig, Philips and Sony.

“In line with changing user and content consumption reflexes, we are very pleased to leave the development of smart TV of our new puhutv product focused on user experience to the deep experience of FOXXUM. We are confident that this long-term collaboration will have successful results”, says Anıl Taşhan, Business Development Manager at puhutv.

“We are very proud to collaborate with the Doğuş Group once again and to develop the app of their AVOD service puhutv. Through this collaboration, we are gaining another valued premium client and further expanding our market share in Turkey”, says Ronny Lutzi, CEO at Foxxum GmbH.

Click here to download as PDF

Foxxum Develops Smart TV App for Australia’s Leading Telecommunications and Technology Company Telstra

ANNOUNCEMENT / May 21, 2021

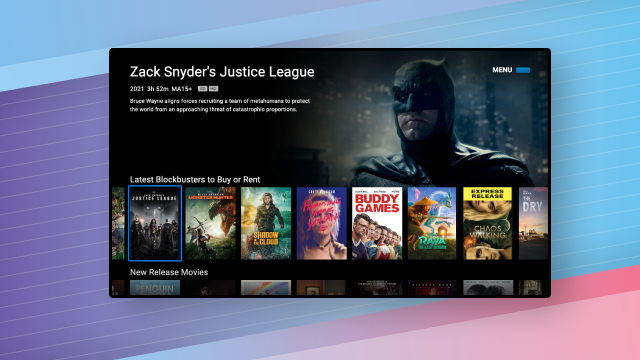

Foxxum has developed its first smart TV app for the Australian market, and the customer is none other than Australia’s leading telecommunications and technology company Telstra. Foxxum has undertaken a complete revamp of the popular Telstra TV Box Office app bringing it up to speed with the latest smart TV trends.

The TVOD offering can be installed on Telstra’s Set-top-box (TelstraTV), PC and laptop as well as iOS and Android mobile phones. The smart TV integration completed by Foxxum, brings the Box Office app to customers’ big screens at home via Panasonic, LG and Samsung devices in Australia.

Telstra TV Box Office contains a large library of recently released and back catalogue movies and TV series and box sets from numerous movie studios and production houses which users can either rent or buy.

“We are very proud that we were able to work with the major telecommunications provider in the Australian market and demonstrate our design, development and delivery qualities”, says Ronny Lutzi, Foxxum CEO.

The app has been available for Australian users since mid-January.

Foxxum & rlaxx TV Bid to Conquer the Avod Market

ANNOUNCEMENT / November 13, 2020

Linear television experience with video-on-demand comfort.

As one of the world’s leading developers of Smart TV apps and platforms, Foxxum knows exactly what a good streaming service needs. With the experience and knowledge of user’s video content consumption, the founders of Foxxum have now launched their own free video streaming product rlaxx TV.

rlaxx TV combines the advantages of a linear television experience with flexible video-on-demand comfort. The content in the rlaxx TV app is presented in theme-based channels, which viewers can simply tune in to avoid long search times. Moreover, it’s possible to skip content by fast-forwarding and rewinding within the channel. Viewers can also access individual videos from the programming at any time in the on-demand section of the service. These features combine the relaxed enjoyment of linear TV with the individuality and precision of video-on-demand, in just one app.

The channel offering, which includes anything from music, sports, kids, lifestyle to adventure as well as international feature films, mainly stems from Foxxum’s extensive content partner network, which expanded over the years and is constantly growing. rlaxx TV is financed through advertising and is therefore completely free for viewers to enjoy.

Through the connection to the sister company Foxxum, rlaxx TV is available from day one in Germany, Austria, Switzerland and UK on Smart TVs from Hisense, Medion, Metz, Sharp, Telefunken, TCL, Toshiba, Vestel, and many more. Currently reaching about 25 percent of the Smart TVs in each of these European markets, rlaxx TV will soon be launched in further countries and all Foxxum-enabled Smart TVs worldwide.

As its official app development partner, Foxxum will also support rlaxx TV in their multiplatform strategy that embraces all OTT devices. At the end of November 2020, rlaxx TV will be launched on Amazon Fire TV. Further apps for other smart TVs, media streamers, mobile phones, tablets, games consoles, desktops and laptops will be released in the next months.

Filmzie, the free movie streaming app, is now available on Foxxum enabled TVs

PRESS RELEASE / September 14, 2020

Kiel, September 14th, 2020: Filmzie a.s., operator of the free movie streaming platform Filmzie, now releases a Smart TV app together with Foxxum GmbH,

an internationally leading Smart TV solutions provider.

Filmzie is on a mission to support independent filmmakers and small studios by providing a platform where they can showcase their films and connect with true film fans. This platform enables filmmakers to reach a broader audience meanwhile allowing movie lovers to enjoy unique, award-winning and hard-to-find movies as well as well-known films, free of charge. Filmzie has already attracted viewers from all over the globe with tens of thousands of active movie watchers on its mobile application (Android & iOS) and web-based platform.

The partnership enables Foxxum to present Filmzie’s large catalogue of high-quality content in their own app store worldwide. Users will appreciate the wide, HD quality video-on-demand content library including all movie genres, top festival winners, independent films, exceptional short movies and much more. Filmzie’s Smart TV app is available on all Foxxum enabled TVs, like Hisense, Sharp, LG, and Amazon Fire TV, Android TV and Samsung meanwhile, app for Panasonic Viera Connect will follow later this year.

“We are thrilled to have created a movie streaming platform with a rapidly growing community that cares about and gives back to the independent movie industry. The launch of our first TV application will only enhance and strengthen our community and we are proud to have worked side-by-side with Foxxum to deliver this app to their users”, expressed Matej Boda, CEO & Founder at Filmzie, a.s.

“We appreciate the intuitive user-friendly concept of Filmzie, especially in times of content overload, and are therefore very happy that this partnership exists. We can now offer this remarkable service in the Foxxum App Store and our users will be able to access a new large content catalogue and social platform specifically for movies.”, says Ronny Lutzi, CEO at Foxxum GmbH.

Click here to download as PDF

SalesTechStar interview with Mehmet Eroglu, Chief Commercial Officer of Foxxum GmbH

PRESS / May 14, 2020

Mehmet reveals the best sales strategies, talks about his experience working in the Smart TV industry, shares good reads and gives an insight into the future of TV.

Can you tell us a little about yourself Mehmet? What are some of the best highlights handling sales for the SmartTV/ B2C segment?

I consider myself as someone who loves to go out onto the field, try to find and meet people and organizations with a need for something that I am offering and who enjoy it as much as I do. Smart TV as a whole, its technology and how it is used and liked by many millions of people globally, provides me the joy of selling something which is adored and used day by day, by so many. That’s why I will always remember the first time when I was standing in the TV and electronics isle of a retail store in Germany, watching 2 friends checking a TV of a brand which uses our Smart TV technology while I was doing some market research myself. These kind of circumstances, I’d always consider as my highlights as it allows me to see the direct impact of what I do- day in, day out.

Given your expertise in Tech/B2B, B2C Business Development and Sales – we’d love to know about some of your top must-haves for a basic Sales or Business Development outreach – what best practices are ideal for a B2B environment versus B2C.

For me as a person, one of the biggest challenges has always consisted of being able to adapt quickly to the person sitting on the other side of the table. This is valid for both environments, B2B and B2C customers. In both cases we still deal with human beings who have different characteristics while taking decisions. Some people are outspoken and loud whereas others are considered introverts who like to speak more about facts and figures rather than start off discussions with small talk. I strongly believe that a good Salesperson is someone who has a general plan of his/her own in mind but is capable of adapting to the personality sitting in front of them. Most important is to keep the “goal” of finalizing the deal in mind and working towards it. In most cases I also think that being prepared and having a healthy “hunter” mentality of never giving up and following up closely goes a long way. And last but not least: The main point is to listen to the needs of customers, whether B2B or B2C and supply them with exactly that.

What would you say are some of the biggest challenges in B2C/B2B sales and business development today? What would your top tips be for them to overcome these challenges?

There are 4 main challenges today that create obstacles for any Business Development and/or Sales professional.

Firstly, to remember to communicate the value of the product: I realized too often early in my career that after several rounds of negotiation I was not focusing anymore on explaining why our products would help the customer but would talk about other issues instead, losing focus on what’s vital.

I also believe that Salespersons should show more and tell less. Especially when selling SaaS or other intangible products, a Demo can change a lot. Words, most of the time are no substitute for images to be shown.

Mapping out the Buyers and understanding who they are and what their needs are, are also the right keys to success. In addition to that, identifying the correct decision-makers on the table are also important in any sales process.

And lastly, being able to connect with the customers emotionally offer tremendous advantages, as it allows to speak openly also about problems when they come along making them easier to solve.

What have been some of your most successful revenue generation and sales tactics and strategies from your time in the industry so far?

Tough question! I am not sure if there is a certain tactic or even trick that can be applied to a success as such. I find it to be usually a combination of many different things. For example: Understanding what the customer needs and how we can offer that; building relations over the years with people in the industry; you may have some customers where the time is simply not right but who then come back to you at a time when you do not expect it. That has actually happened quite a lot to me and has also created some successful revenues for our company.

How according to you will the typical role of tomorrow’s B2B/Technology sales person evolve, given the dynamics and innovations in salestech today? What should today’s salesperson do to prepare for the future role of tomorrow?

I believe that the key word or answer to this is to anticipate and to embrace change. Changes are and will always be happening. Change is also in the DNA of our industry. We need to believe and understand that change is inevitable and that each change brings new opportunities. For example: The B2B customer has also dramatically changed when I compare them to my first years in the industry to today. In the past we would go and knock on the door of B2B customers and explain to them what we offer and who we are. If they would have a need right in that moment, chances were high, they would agree to buy or contact you when they are ready to buy. Nowadays it is not that simple anymore, as many B2B customers have much higher requirements and boundaries where a simple visit and introduction alone does not guarantee the success of the sale. To understand how they changed and adjust yourself and the company to it, is the key ingredient to create future success.

What would you say or do in your capacity to turn Sales and Business Development into the most exciting job of the decade?!

For me it is already the most exciting job of the decade otherwise, I would not be doing this for more than a decade…!!!

Tag (mention/write about) the one person in the industry whose answers to these questions you would love to read!

#Michael Paull, President at Disney Streaming services

Your favorite Sales/SalesTech quote and sales leadership books you’d suggest everyone in Sales reads

There are a lot of fantastic books out there that over time allowed me to learn from and utilize in my own little ways. Some of them are “classics” that I would suggest to everyone working in Sales and Business Development. “Winning” by Jack Welch and “Getting to Yes” by Fischer, Ury and Patton are 2 of those must-reads for me. I also believe that anyone aspiring to become a sales expert and leader within any organization should be reading the “The Goal” by M. Goldratt and “The Art of the Start” by G. Kawasaki, as both books provide different insights on how organizations work and how success itself is a mixture of “traditional” business management as well as entrepreneurship in many different ways.

Tell us about some of the top sales/salestech/fintech/ other events that you’ll be participating in (virtually!) (as a speaker or guest!) in 2020!

As you know, we are experiencing some challenging times right now, on a global scale making those attendances quite difficult due to the Covid-19 pandemic. Before this however, I was planning to attend multiple events during 2020 which now are mostly on hold for the greater good of course. Like many, I also hope and believe we will defeat this virus and return to normal times very soon, allowing again to exchange ideas and business thoughts during future events.

We’d love to know a little about your future plans!

We are very excited to be launching our new OTT service called “Rlaxx.tv” very soon. It will be our very first B2C product which entails the mission of bringing (back) lean-back TV experience to Smart TV’s. In today’s world of connected devices and applications the supply of content is massive which causes end users to spend a lot of time whilst searching for content. “Rlaxx.tv” is a product that is based on our philosophy of “Launch, lean back and relax!” and hence allows end users to simply watch any content of their interest on their Smart TV’s without all the hassle of surfing through many different apps. Especially in the US there is a big demand of this type of content consumption now. We plan to apply this idea on all other markets outside the USA towards and by the end of the year. Our installed Smart TV base as well as our existing partnerships with content partners allow us a quick market entry. At the same time, we are also capable to launch on all relevant devices worldwide as we have an experienced and very talented development team behind Rlaxx.tv.

Foxxum and TELE 5 release Smart TV app 5flix

PRESS RELEASE / May 5, 2020

Kiel, May 5th, 2020: Foxxum is excited to announce the official launch of 5flix, the new Smart TV app of the German television broadcaster TELE 5.

The app is the result of the newly formed partnership between TELE 5 and Foxxum, innovator in cutting-edge Smart TV solutions for TV manufacturers and content providers, who have developed the app which will now be available on various platforms in Germany and Austria.

TELE 5 has become a successful private television broadcaster in the DACH region and is famous for its “Different is better” approach, which is mainly reflected by their eclectic and offbeat choice of content. Their carefully selected content library has already won over a large fanbase, by not showing the mainstream movies and series, but focusing on unique films and shows viewers would otherwise have missed.

5flix is an advertising-based video-on-demand service, which is a significant step for TELE 5 as it enables everyone to access their exclusive video portfolio free of charge. TELE 5 has won over the German artist Liam Mockridge as ambassador around the campaign. He has delivered a humorous 90s style commercial in which he sings a song explaining why he loves his 5flix app to promote the app launch.

Within this app users have access to hundreds of movies and series in German language. 5flix features iconic action classics, sparkling romance series, horror movies, SciFi series and inhouse productions such as “SchleFaZ – the worst movies ever”. Additionally, some of the regions’ biggest comedians feature their independently produced shows in the app: Serdar Somuncu’s “KAFFEEPAUSE”, Oliver Kalkofe’s “MATTSCHEIBE” and many more. Besides the VOD library, 5flix also contains the original Live TV channel of TELE 5.

Through this collaboration, the Smart TV app will be available on LG, Fire TV, Samsung and Android TV as well as Foxxum enabled devices such as VESTEL, Sharp, Medion, Hisense, Metz, JTC and many more. Users can now enjoy the diverse TELE 5 library via 5flix and stream all content around the clock for free.

“With Foxxum we have found the perfect partner to develop the 5flix app for Smart TV devices. We are very pleased to work with a business partner who truly understands what TELE 5 stands for and who is able to transfer the spirit of our channel into a great VOD application for the big screen. With this brand-new service our fans have the possibility to stream their favorite TELE 5 movies and series comfortably at home on TV – at anytime”, says Michael Damm, CDO at TELE 5.

“Our partnership with TELE 5 means a huge expansion of our content library for our native market. 5flix fills our Smart TV app store with peculiar German content, which perfectly caters to users’ modern demands. This fresh content, in combination with our user-friendly app UI design, serves the best Smart TV experience”, says Ronny Lutzi, CEO at Foxxum GmbH.

Click here to download as PDF

Will you be at the Global Content Bazar India?

EVENTS / January 27, 2020

Ravi Kumar, responsible for Content Partnerships in India and Southeast Asia, will attend this year’s Global Content Bazar India in Mumbai.

He would be glad to meet you there. Please follow the link below to book your meeting. Looking forward to hearing from you!

Book Now

26 days – Are you CES ready?

EVENTS / December 12, 2019

Foxxum’s Chief Executive Officer Ronny Lutzi is attending the CES 2020 together with his expert team composed of Business Development and Content Partnerships representatives.

The group consists of Jenny Qi, Vice President China, Mehmet Eroglu, Chief Commercial Officer, Teresa Alonso Lopez, Manager Content Partnerships and Bogdan Logvinov, Senior Associate Content Partnerships.

If you want to get together with them and haven’t booked your appointment yet, then please follow the link below to get in touch with us. We can’t wait to see you!

Book Now

The countdown to CES Las Vegas 2020 starts now

EVENTS / November 7, 2019

61 days – We are counting down to the start of CES 2020 in Las Vegas.

No matter if you are already a partner, interested in our products or want to chat about all things Smart TV, simply follow the link below to book your meeting with us.

We can’t wait to see you!

Book Now

We want to see you at IFA & IBC 2019

EVENTS / August 20, 2019

Book your appointment

New Year, new Look – Meet our new logo

ANNOUNCEMENT / January 10, 2019

Today we proudly present our new logo. As we constantly grow and become more mature we felt it was time to represent that in a new logo but without loosing our recall value. We are now using a fresher green and modern font that is optimised for mobile screens. Furthermore we added a box, showing the FOXXUM X, which is a mixture of an app icon and a TV screen representing our work and passion.

If you are a partner and you are using our logo please request a full resolution logo at designteam@foxxum.com

Meet us at IFA, IBC and MIPCOM

EVENTS / August 1, 2018

Pack your bags – Exhibition season is here!

Whilst struggling to close our suitcases, we hope that you are as excited as we are for IFA, IBC and MIPCOM.

You’ve booked your tickets? Let’s meet! We are continuously searching for new business opportunities, distribution channels, new devices as well as content.

Follow the link below to arrange a meet up at one of the fairs. We can’t wait to see you!

Book your meeting

Foxxum is coming to CES Vegas, you too?

EVENTS / December 7, 2017

Technology is borderless. This year as always, we are bringing our leading Smart TV solutions to the Consumer Technology Trade Show in Vegas. As an international team, Foxxum commits itself to optimizing Smart TV user experience by bridging manufactures and content providers across the globe. We are seeking to expand our service region, diversify contents and increase the number of supported devices.

Do we share the same goal? Let’s connect.

Book your meeting

Meet us at IFA, dmexco and IBC

EVENTS / August 17, 2017

Like every year, we are delighted to meet our current and new partners at trade shows like IFA, dmexco and IBC.

If you have a business proposal, are looking for distribution channels for your content or own a device which does not contain content yet, please send us a message and let us know your availability to meet up.

It would be great to get to know you and to find a way of working together. We are always open to new opportunities!

Book your meeting

Partner with Foxxum at ANGA COM

EVENTS / May 22, 2017

With the latest innovative Smart TV technology, a global application portfolio that contains unlimited hours of entertainment and an outstanding TV Store design, Foxxum offers the best Smart TV experience for end-users, TV manufacturers and content providers.

Learn more about our current projects, discover some of the new features of our Smart TV Solution and be part of our future plans.

Come and meet us at ANGA COM in Cologne

Book your meeting

Meet us at CES 2017

EVENTS / December 19, 2016

New year, new plans

Las Vegas celebrates 50 years of success with the long-awaited consumer electronics and consumer technology tradeshow: CES 2017.

Let’s make out of 2017 a promising year together in the Smart TV world!

Come and meet us at CES, Las Vegas.

Click here to book your meeting

New trade fairs, new opportunities

PRESS RELEASE / September 15, 2016

FOXXUM is going there where business takes place and partnerships are born. Next stops are China and France! We will be in Canton Fair, the largest biannual trade fair held in Guangzhou and it goes on with MIPCOM in Cannes, the world’s entertainment content market. We would like to meet you in person and explore new collaboration opportunities. Join us and lead with us the Smart TV industry with the biggest players

Meet us at IFA, IBC and Dmexco

EVENTS / August 25, 2016

New insights into the Smart TV world

Learn more about Foxxum’s products and our new partners at IFA in Berlin, IBC in Amsterdam and Dmexco in Cologne. Check our Smart TV Store live at our customers’ exhibition booths.

If you are a content provider looking for different ways to expand to new territories, a Smart TV or STB manufacturer who would like to enrich your content portfolio, or if you have any plans to enter the Smart TV world but still need to explore new possibilities, this is your chance.

Click here to book your meeting

Express Luck signs with Foxxum to exclusively deliver Smart TV solution

RELEASE / July 7, 2016

Chinese TV manufacturer to enter European Smart TV business

Expressluck International, one of the largest TV manufacturers in China, has signed Foxxum to provide an exclusive Smart TV solution to its Romanian subsidiary Contex Digital Electronics SRL. Both companies are going to develop a new Smart TV product range to extend their recent impact within TV markets all across Europe. The Foxxum Smart TV solution will enhance Expressluck‘s own brands as well as future OEM devices with a rich set of features, a state-of-the-art user experience as well as a high quality local and global content portfolio.

“It has always been clear to us, that we as a company will only work with very experienced, flexible and innovative partners – particularly when entering new markets or segments. Foxxum has met all of our expectations from day one and pushed us even further to a point, where we will make a heavy impact on all European Smart TV markets. We are looking forward to many more supporting ideas and innovations from our new partner Foxxum”,

explains Jacky Dong, Europe TV Director at Expressluck.

“We are proud of Expressluck‘s decision to put us in charge of their Smart TV solution for the entire European market. Together we will create something great – for the users and the company – by combining exceptional hardware, the most advanced Smart TV solution, attractive content and customer oriented business models. Expressluck has an outstanding ambition in conquering the European market and we are going to support it by any means of our expertise“,

says Ronny Lutzi, CEO at Foxxum.

About Expressluck International Company Limited

Expressluck International supported by its European subsidiary Contex Digital Electronics SRL, is one of the foremost professional manufacturers of LED TVs in China and Romania. Through dedicated and effective research and development, as well as its’ belief in continuous improvement, Expressluck continues its quest for leadership in the flat panel TV marketplace. Expressluck manufactured products have a proven sales record in East Asia, Europe and North America and have established a stable sales network and maintained sound cooperative relationships with many of the world’s largest retailers.

Click here to read the complete press release.

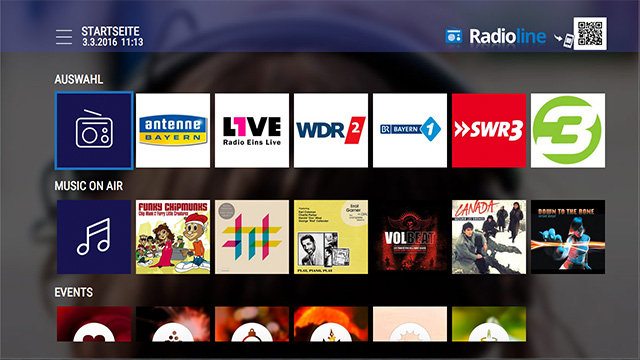

Radioline and Foxxum launch a strategic partnership

RELEASE / March 21, 2016

Radioline – the first European aggregation platform of radio stations and podcasts – and Foxxum, worldwide leading provider of Smart TV Solutions, today announce a strategic partnership to jointly work on further shaping a strong international Smart TV environment for radio stations and radio content.

As Smart TV is the number three device category after mobile and PC used for online radio listening in the US and in France, it has become a strategical element and distribution channel for the entire radio industry. Therefor Radioline has developed a full range of solutions for TV, including an HTML5 TV application that is now made available on all devices using the Foxxum portal. While Radioline adds even more international high quality content to the Foxxum bouquet, for their aggregated radio content providers the integration process is a one step expansion to a very large number of Smart TV devices worldwide, including international TV and set-top-box brands such as Hisense, Haier, Sharp, Orion, Medion, Metz, and many more.

“This partnership with Foxxum, one of the most demanding and reliable Smart TV Platform Solutions with strong positions within markets all over the globe strengthens Radioline’s footprint on connected TV” says Geoffroy Robin, CEO at Radioline.

“Radioline’s innovation, experience and vision of a strong Smart TV based radio distribution is a perfect match with our philosophy bringing relevant, high quality international content to Smart TV devices – in this case especially to those connected to the best audio solution within the household” says Ronny Lutzi, CEO of Foxxum.

The TV app is available in 6 languages (French, English, German, Dutch, Italian, Spanish) and offers the biggest European catalogue of 60,000 radio stations and podcasts from 130 countries, including great functionalities (favorites, access by topics, music genres, countries…).

DW content is now available on connected devices worldwide

APP RELEASE / February 28, 2015

Deutsche Welle (DW), Germany’s international broadcaster offering news, features and documentaries covering everything from business, science and politics to arts, culture and sports, is now available on all Foxxum partner brands and devices worldwide, such as Blaupunkt, Haier, Hisense, Medion, Sharp and Vantage. The according app has been developed by Foxxum, leading provider of Smart TV Solutions, itself and in close cooperation with DW. Depending on user‘s hardware, even live streaming will be available within the application.

The new app offers dynamic search and a very intuitive structure in order to get straight to the content desired, sorted in Latest, Programs, Lifestyle & Culture, Business, Politics & Society, Science & Health, Travel, Sports and Automotive. All content – live and on demand – will be available in German, English, Spanish and Arabic right from the start with more languages coming soon.

“Adding to our global satellite network, partner stations and online services, distributing our VOD and live TV content via Smart TV and OTT Solutions became an important part of our distribution strategy,” explains Petra Schneider, Director of Sales and Distribution at DW. “In one single step, Foxxum has proven to be a great addition to our partner network by opening doors to a wide range of devices and audiences in many different countries.”

“Bringing together hardware platforms and attractive, relevant content on an international scale – that‘s what Foxxum Smart TV Solutions are about. With Deutsche Welle we now have another unique partner who represents high quality content in the strongest and purest possible way“, so Ronny Lutzi, CEO at Foxxum.

Meet us at CES 2016

EVENTS / December 17, 2015

Do not miss the opportunity to learn more about Foxxums current projects, products, new features and future plans. We will be at CES, the global consumer electronics and technology conference. Foxxum is permanently interested in new partnerships that contribute to our outstanding international content portfolio and innovative solutions.

Foxxum is a global leader in the development, operation and commercial marketing for innovative Smart TV Solutions. As an established pioneer in the sector, Foxxum works closely with leading companies at all stages of the global consumer electronics value chain to develop Smart TV Solutions – from silicon vendors to device manufacturers and network operators. Worldwide partnerships with premium broadcasters, the most important video producers and distributors allow Foxxum to provide a best in class content portfolio containing the most important global content brands as well as country specific local content providers.

Contact

Americas

Av. Queiroz Filho, 1700,

sala 403 Torre E - V. Hamburguesa

05319-000 - São Paulo - SP

Brazil

Middle East & North Africa

Büyükdere Caddesi No: 257

Nurol Plaza 21/a

Maslak / Sarıyer

34398 Istanbul

Turkey

China

UCOMMUNE, Attn: Jenny Qi

14th Floor, Zone B, Haian Building (East Tower)

No 15, Haide 3rd Road

Nanshan District, Shenzhen, 518000

China