Foxxum App Solutions

- Distribution & Monetization

- UX/UI Design

- App Development

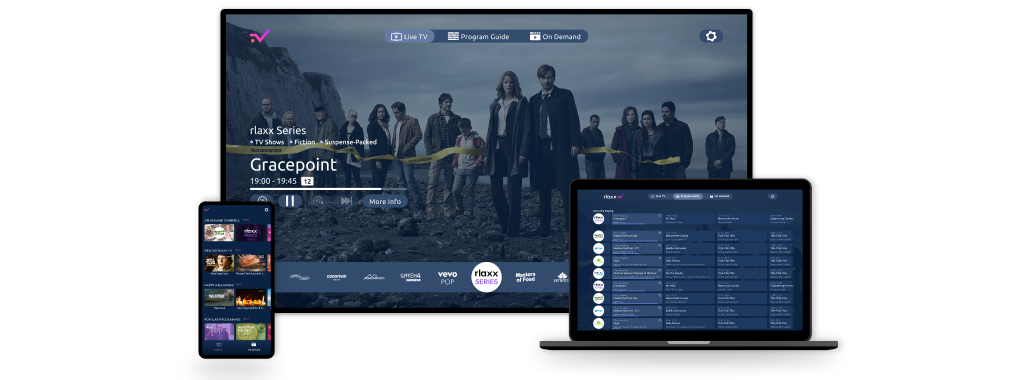

Creating custom, innovative and high-scalable Apps for Connected Devices

Foxxum provides cutting-edge innovation in app development for Connected TVs (CTV) and all connected devices. At Foxxum, we leverage our expertise to craft exceptional apps that redefine digital entertainment landscapes.

Our seasoned team combines technical prowess with a deep understanding of Smart TV and connected device technology, ensuring your apps resonate with the ever-evolving demands of the audience.

Expertise in CTV App UX/UI Design

Discover the Foxxum advantage – a perfect blend of technical proficiency and a commitment to stunning UX/UI design for your Connected Device and Smart TV apps. From ideation to deployment, our meticulous process ensures a harmonious fusion of functionality, aesthetics, and user engagement.

Monetize your Product

The art of “making money” in Smart TV for Device Brands and Content Providers has been crafted by our team since the first days of Smart TV. Worldwide reach, tools to maximize traffic and well-proven monetization strategies are the essence for the commercial success of the customers.

Latest News

Foxxum, ZEASN, and rlaxx TV Shine at IBC 2023 in Amsterdam

The IBC 2023 in Amsterdam proved to be a resounding success as Foxxum, ZEASN, and rlaxx TV delivered an unforgettable showcase of their latest innovations in CTV technology.

At the heart of their presentation was the highly-anticipated demonstration of Whale OS and its impressive array of features. Attendees were highly impressed by the seamless integration of content, applications, and AI-driven enhancements. The AI features of Whale OS were especially popular, leaving people astounded by its capabilities.

The trio’s booth was a testament to innovative design, drawing visitors in with its futuristic aesthetics, immersive displays and for everyone’s delight: a serving of fresh popcorn. This modern but homelike design served as a fitting backdrop for showcasing the companies’ collective vision for the future of connected TV.

This remarkable success was achieved through incredible teamwork within a very short time, as the acquisition of Foxxum and rlaxx TV by ZEASN only took place in August 2023. The new group seamlessly collaborated to create an unforgettable experience for IBC 2023 attendees.

Moreover, the IBC 2023 audience was treated to captivating speeches by industry luminaries Dr. Jack Gao and Professor Feida Zhu. Their insights and vision for the future left a lasting impression on all who attended.

As the curtains close on IBC 2023, Foxxum, ZEASN, and rlaxx TV are excited to announce their commitment to returning next year, promising even more groundbreaking innovations and industry-leading presentations. The future of smart TV looks brighter than ever – See you at IBC 2024!

Foxxum will be at IBC 2023 in Amsterdam!

We are happy to announce that Foxxum will be present at the International Broadcasting Convention (IBC) in Amsterdam this September 15-18! IBC is the premier event for professionals involved in the creation, management and delivery of entertainment and news content worldwide.

This year, we are taking our presence at IBC to a whole new level by teaming up with our new acquisition partner, ZEASN. Together, we aim to revolutionize the CTV entertainment landscape and redefine the way people experience content on smart TVs and connected devices.

Join us at booth #5.A08 to explore our cutting-edge solutions and experience first-hand the power of our partnership with ZEASN. Our team will be on hand to demonstrate our latest innovations, showcase our diverse range of applications, and discuss how our combined strengths will reshape the future of the smart TV experience.

Don’t miss this opportunity to connect with Foxxum and ZEASN and stay ahead of the rapidly evolving trends in the industry. We look forward to meeting you at IBC 2023 and forging new collaborations that will drive the future of CTV entertainment!

Book your meeting with our colleagues via email info@foxxum.com

Use our Customer Code IBC10100 and get your tickets now!